The EU-Commission hat to recalculate the duties due to a decision of the European High Court. The final results of this recalculation have today been published, here the information at a glance:

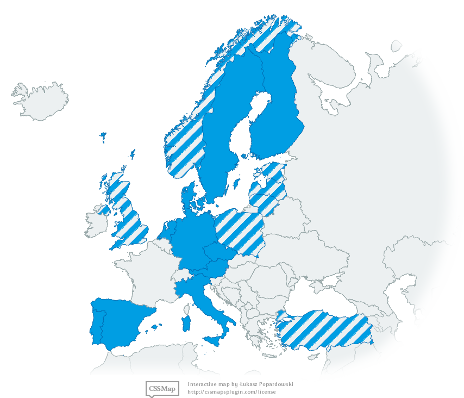

As from tomorrow, the imports in the EU will be subjected to the duties and no longer be registered. The customs authorities

will require importers to pay the duties on the imports registered since July 2022. As the duties were reduced, importers will

also have the possibility to request custom authorities to refund part of the duties paid since the implementation of the original measures.

We note that the overall level of duties was further reduced for Hankook by 1.6 EUR/unit compared to the findings of the additional disclosure

of end January as a result of “a clerical error” identified in the injury margin calculation. This also led to a further reduction by 0.6 EUR/ unit

of the duties for the non-sampled cooperating Chinese producers.

Overall, compared to the duties which applied prior to the Court’s ruling, the reduction of the duties following the re-opening of the investigation is as follows:

| Total level of duties (AD and AS in EUR/Unit) |

Reduction of the duties | |||

| Initial investigation | Re-opening | EUR/Unit | in % | |

| Aeolus Group and Pirelli | 49,44 | 39,77 | 9,67 | 20% |

| Giti Group | 47,96 | 46,81 | 1,15 | 2% |

| Hankook Group | 42,73 | 21,12 | 21,61 | 51% |

| Xingyuan Group (duties were not annuled for that company and therefore remain unchanged) | 61,76 | 61,76 | 0 | 0% |

| Other companies cooperating in both anti-subsidy and anti-dumping investigation listed in the Annex | 49,31 | 38,56 | 10,75 | 22% |

| Zhongce Rubber Group Co. ltd | 57,28 | 57,28 | 0 | 0% |

| Weifang Yuelong Rubber; Hefei Wanli Tire | 61,76 | 61,76 | 0 | 0% |